Empowering Your Financial Future

Rapid Factoring Services

Management

Credit Limits

Reports

User Management

Transactions

Underwriting

Support

Documents

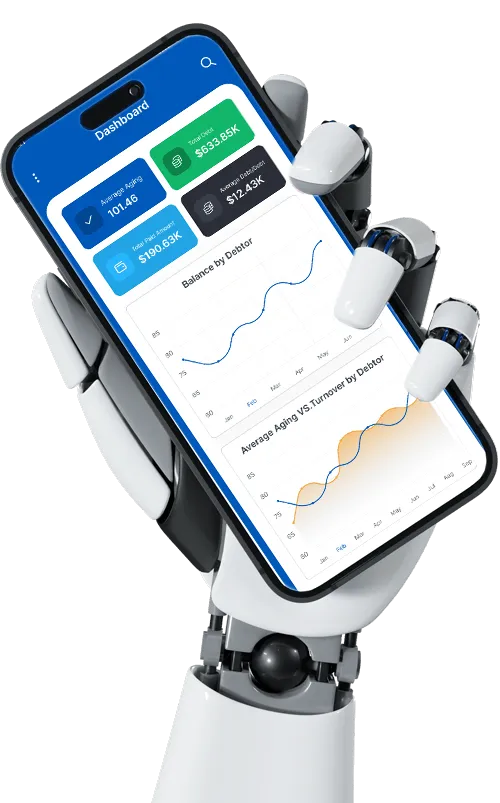

Dashboard

Key Advantages

Real-Time Insights.

Access essential information at a glance for informed decision-making.

Customizable Views.

Personalize your dashboard to focus on critical metrics.

Management

Prospects

Factor Flow empowers efficient prospect management, nurturing potential business opportunities and accelerating conversion rates.

- Robust Prospect Database: Easily access and organize prospect information.

- Activity Tracking: Stay on top of prospect interactions and engagements.

- Customizable Pipelines: Tailor prospect management to match your unique sales funnel.

- Reporting and Analytics: Gain valuable insights for data-driven decisions.

Clients

Deliver exceptional service with Factor Flow client management tools.

- Comprehensive Client Profiles: Access essential client details and preferences.

- Efficient Transaction Processing: Streamline transaction processing for timely service.

- Real-Time Updates: Keep clients informed with real-time updates.

- Customizable Reporting: Generate tailored reports to share insights with clients.

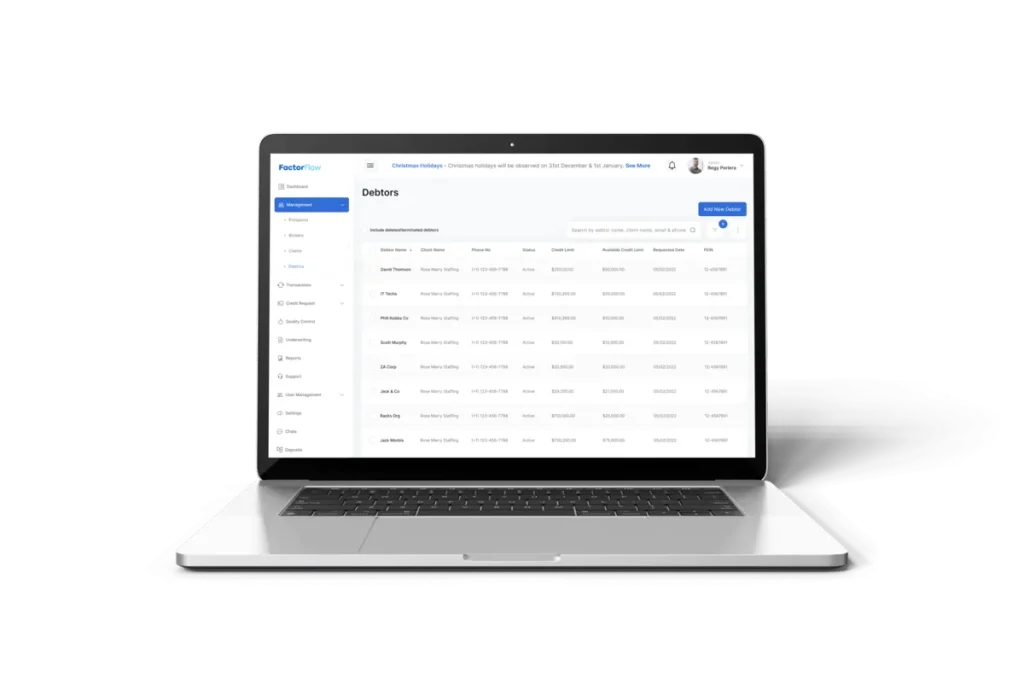

Debtors

Effectively manage debtor interactions and collections with Factor Flow.

- Holistic Debtor Profiles: Gain a comprehensive view of each debtor.

- Automated Collection Workflows: Streamline collection processes with automation.

- Real-Time Alerts: Stay proactive with timely alerts.

- Integrated Communication: Engage debtors seamlessly through integrated tools.

Brokers

Factor Flow supports smooth broker management and collaboration.

- Broker Portal: Dedicated portal for brokers to access information and submit deals.

- Deal Progress Tracking: Monitor broker-submitted deal progress with ease.

- Performance Reports: Offer detailed reports for transparent partnerships.

- Easy Document Sharing: Simplify document sharing for efficiency and accuracy.

Streamline and Optimize Your Financial Transactions

Transactions

Key Transaction Features

Invoices.

Effortlessly generate and process invoices, enabling swift and accurate billing for your clients.

Schedule of Assignment.

Keep track of assignments with a comprehensive schedule, ensuring transparency in your financial transactions.

Schedule of Funding.

Facilitate timely funding processes with a well-organized schedule, streamlining your cash flow management.

Collections.

Effectively manage collections with automated workflows and real-time tracking, optimizing debt recovery.

Chargebacks.

Handle chargebacks efficiently, ensuring accurate adjustments and maintaining transparent records.

Reserves.

Seamlessly manage reserves, ensuring proper allocation and utilization of funds for risk management.

Unapplied Cash.

Keep a detailed record of unapplied cash, facilitating necessary actions and updates as required.

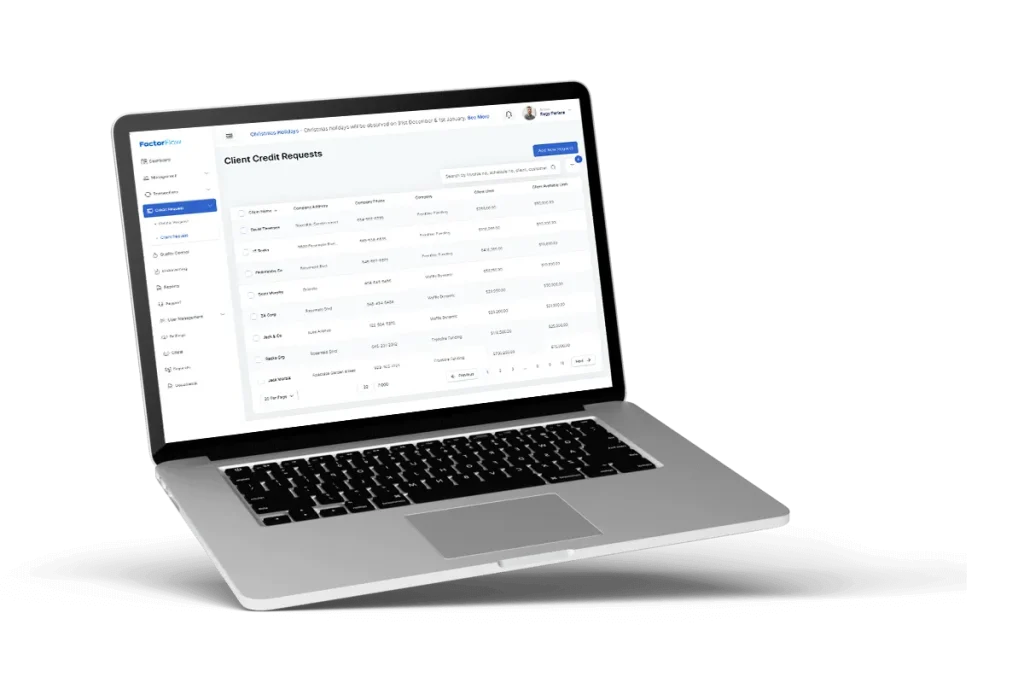

Credit Limits

Effortlessly set and manage credit limits within Factor Flow.

Key Features

- Client Credit Request: Establish credit limits for each client, tailored to their specific needs.

- Debtor Credit Request: Set credit limits for debtors, ensuring risk management and efficient credit control.

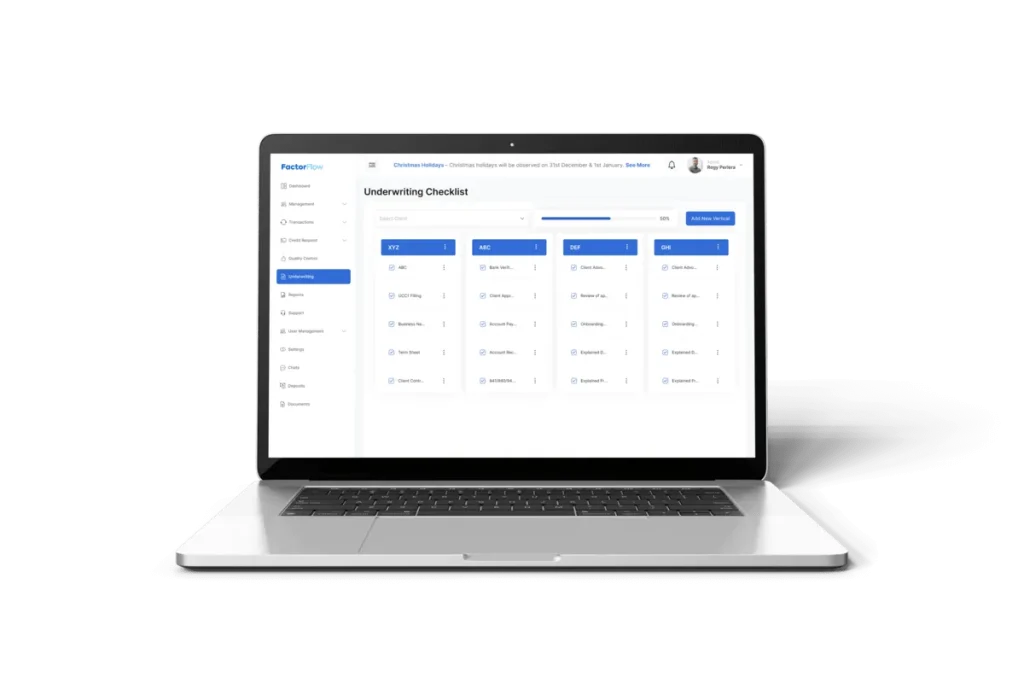

Underwriting

Optimize underwriting processes with Factor Flow.

Key Advantages

- Streamlined Underwriting: Effortlessly manage underwriting tasks and workflows.

- Risk Assessment: Make well-informed decisions with comprehensive risk assessment tools.

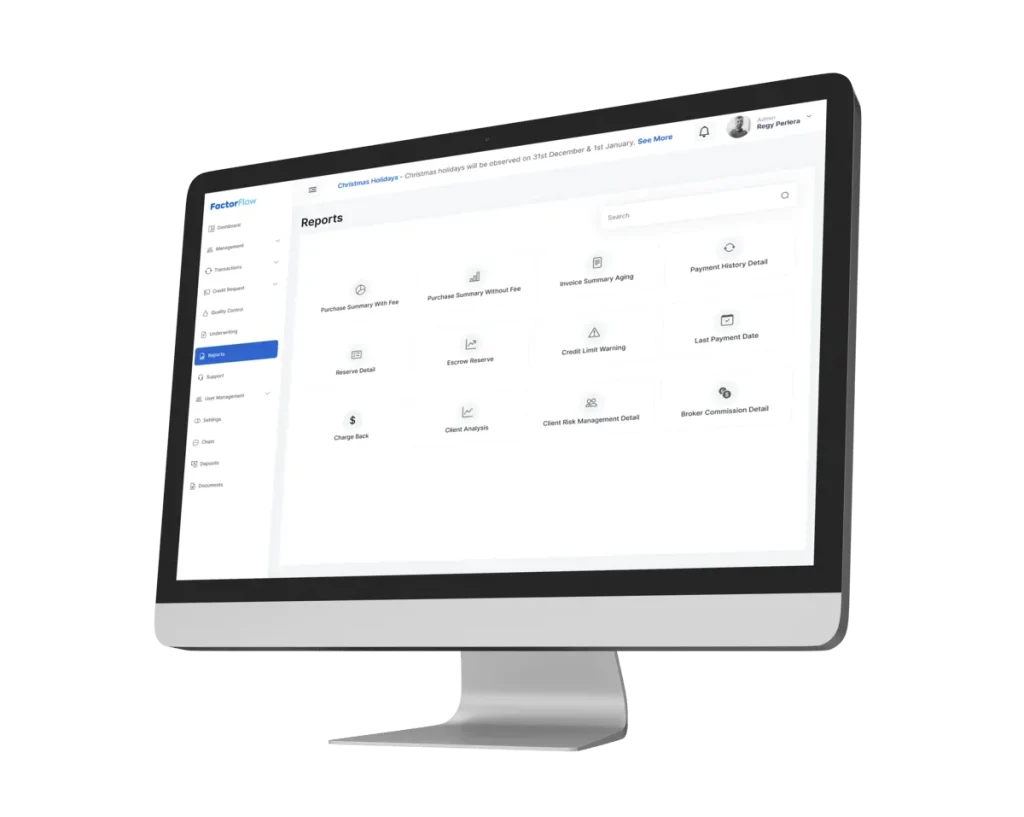

Reports

Gain valuable insights with comprehensive reports in Factor Flow.

Highlights

- Tailored Reports: Generate custom reports to suit your business needs.

- Data Analysis: Utilize data-driven insights for informed decision-making.

Support

Why Choose Factor Flow Support?

Responsive Assistance.

Prompt responses to your queries and concerns are just a click or call away.

Expert Guidance.

Our knowledgeable Support professionals offer expert guidance on utilizing Factor Flow to its fullest potential.

Tailored Solutions.

We provide customized solutions to meet the unique needs of your organization.

Continuous Improvement.

Your feedback helps us enhance our services for an even better user experience.

User Management

Efficiently manage users and their roles within Factor Flow.

Key Features

- User Profiles: Access and organize user information effortlessly.

- Roles & Rights: Assign precise access rights to each user based on their roles.

Documents

Simplify document management with Factor Flow.

Highlights

- Centralized Storage: Archive and access various business documents securely.

- Easy Retrieval: Quickly retrieve and share documents as needed.